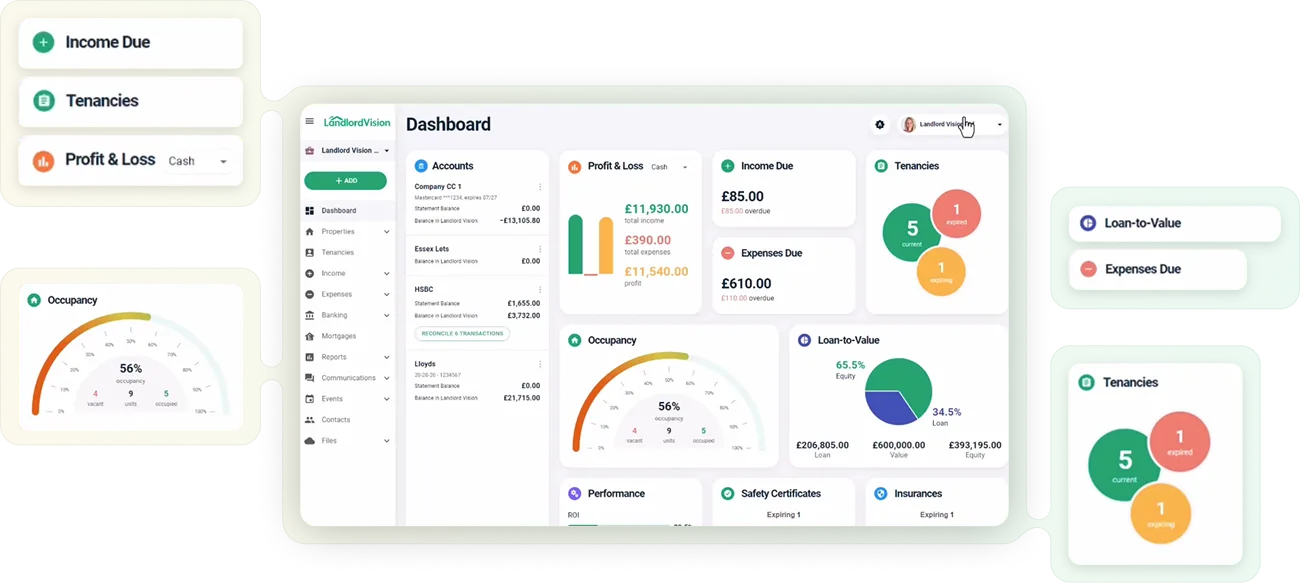

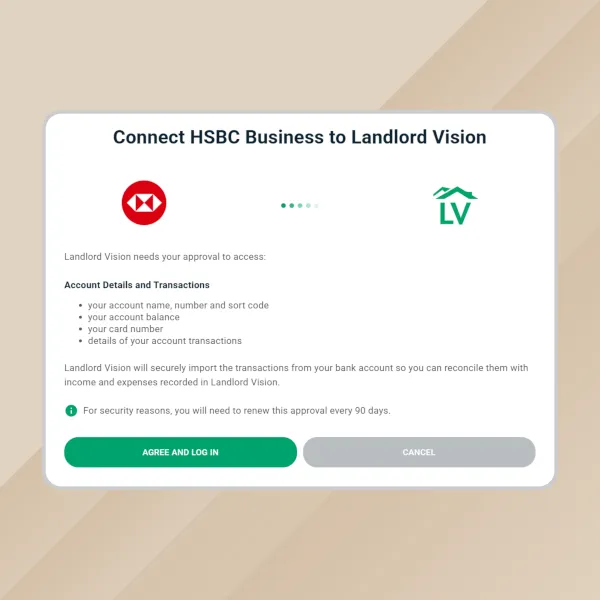

Bank Integration

Secure Bank Feeds

✔ Automatic transaction syncing

✔ Supports multiple accounts

Automatic Transaction Import

✔Rent and expenses pulled in continuously

✔Always up-to-date data

Intelligent Transaction Matching

✔ Match rent payments to expected rent

✔Assign expenses to the right property

✔Reduce unmatched transactions

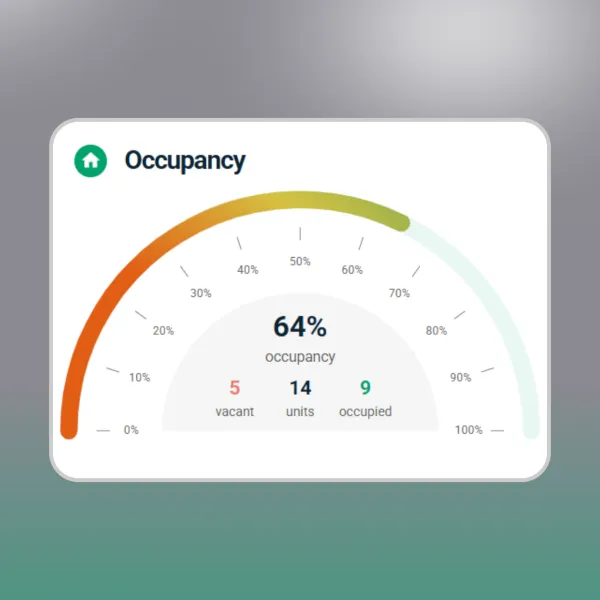

Automated Reconciliation

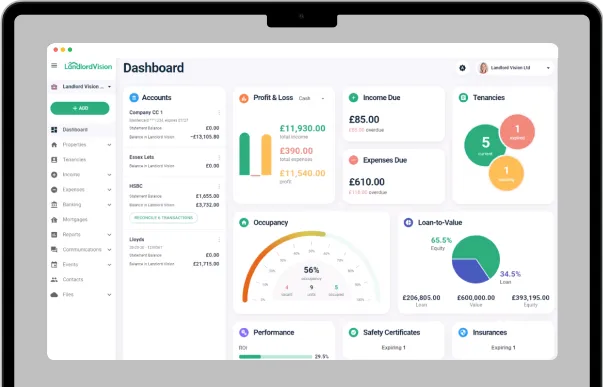

Property-Level Accuracy

✔Assign transactions to properties

✔Maintain portfolio separation

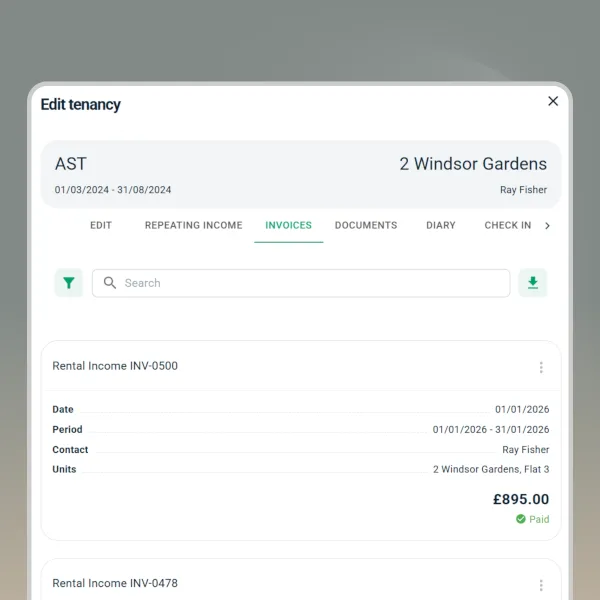

Clear Audit Trails

✔Full transaction history

✔Linked to rent and expenses

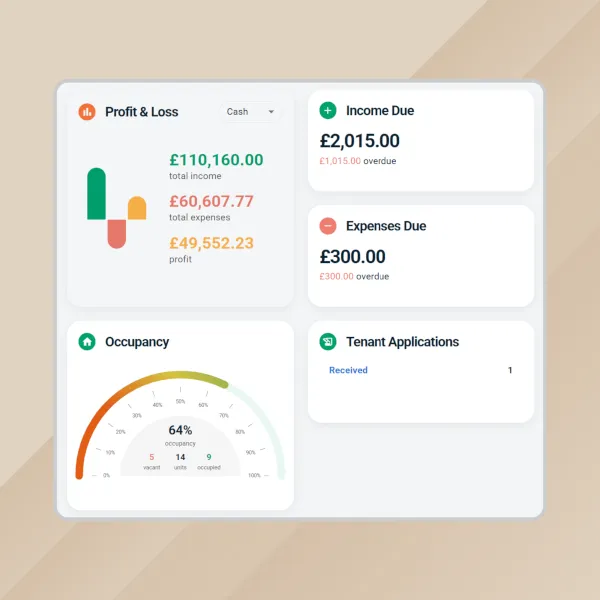

Real-Time Financial Confidence

✔No backlog

✔Always accurate reports